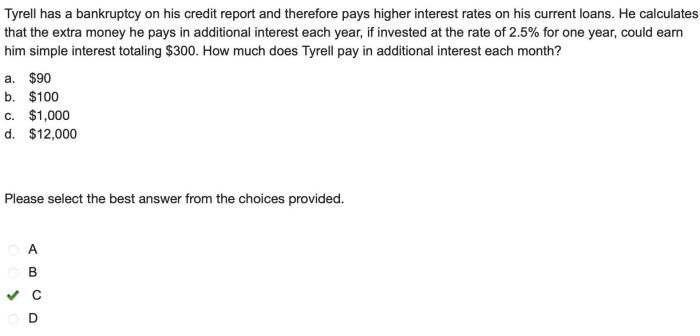

Tyrell has a bankruptcy on his credit report – Tyrell’s Bankruptcy: Impact on His Credit Report unveils a compelling exploration into the consequences of financial distress. This comprehensive analysis delves into the complexities of bankruptcy, its repercussions on creditworthiness, and the intricate legal implications involved.

The narrative unfolds with an examination of bankruptcy’s definition and its various forms. It meticulously dissects how bankruptcy can inflict damage upon an individual’s credit score, casting a shadow over their financial standing for an extended period.

Bankruptcy Definition

Bankruptcy is a legal proceeding initiated when an individual or organization is unable to repay outstanding debts or obligations. It involves the surrender of assets to a court-appointed trustee, who then distributes the proceeds to creditors in accordance with applicable laws and regulations.

Types of Bankruptcy

- Chapter 7 Bankruptcy:Liquidation of non-exempt assets to pay creditors.

- Chapter 11 Bankruptcy:Reorganization of debts and assets to continue business operations.

- Chapter 12 Bankruptcy:Reorganization of debts for family farmers or fishermen.

- Chapter 13 Bankruptcy:Repayment of debts over a period of time through a court-approved plan.

Impact on Credit Report

- Bankruptcy remains on a credit report for 7-10 years, depending on the type of bankruptcy filed.

- Bankruptcy significantly lowers credit scores, making it difficult to obtain new credit or loans.

- Bankruptcy can impact creditworthiness for years, even after the bankruptcy is discharged.

Impact of Bankruptcy on Credit Report

Negative Impact on Credit Score

Bankruptcy has a severe negative impact on credit scores. The FICO score, widely used by lenders, deducts a significant number of points for bankruptcy filings, ranging from 100 to 200 points.

Time Frame on Credit Report

Bankruptcy remains on a credit report for 7 years from the date of filing for Chapter 13 bankruptcy and 10 years from the date of filing for Chapter 7 bankruptcy.

Ability to Obtain Credit

Bankruptcy can make it extremely difficult to obtain new credit or loans. Lenders are hesitant to extend credit to individuals with a bankruptcy on their credit report due to the perceived high risk of default.

Credit Repair After Bankruptcy

Steps to Repair Credit, Tyrell has a bankruptcy on his credit report

- Review Credit Report:Obtain a copy of the credit report and identify any errors or inaccuracies.

- Pay Bills on Time:Establish a consistent pattern of on-time payments for all debts.

- Reduce Debt:Work towards reducing outstanding debt balances to improve credit utilization ratio.

- Build Positive Credit History:Use secured credit cards or become an authorized user on someone else’s credit card to build a positive payment history.

Timeline for Rebuilding Credit

Rebuilding credit after bankruptcy takes time and effort. It typically takes several years to significantly improve a credit score after a bankruptcy filing.

Pitfalls to Avoid

- Avoid New Debt:Refrain from taking on new debt until the credit score has improved.

- Be Patient:Credit repair is a gradual process that requires patience and consistency.

- Seek Professional Help:Consider consulting a credit counselor or financial advisor for guidance and support.

Legal Implications of Bankruptcy

Consequences of Filing

- Loss of Assets:Non-exempt assets may be liquidated to pay creditors.

- Impact on Debt:Some debts, such as student loans and child support, may not be dischargeable in bankruptcy.

- Legal Restrictions:Bankrupts may face restrictions on future financial activities, such as obtaining certain types of licenses or holding certain positions.

Role of Bankruptcy Attorney

A bankruptcy attorney plays a crucial role in the bankruptcy process by:

- Advising on bankruptcy options and eligibility.

- Preparing and filing bankruptcy petitions.

- Representing clients in court proceedings.

Alternatives to Bankruptcy: Tyrell Has A Bankruptcy On His Credit Report

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can reduce monthly payments and make it easier to manage debt.

Credit Counseling

Credit counseling provides individuals with financial education, budgeting assistance, and debt management plans. Credit counselors can help negotiate with creditors and develop strategies to reduce debt.

Comparison to Bankruptcy

- Bankruptcy:Involves court proceedings, loss of assets, and a negative impact on credit.

- Alternatives:Preserve assets, maintain creditworthiness, but may not fully resolve debt issues.

Choosing the Right Option

The best option for an individual facing financial hardship depends on their specific financial situation, debt levels, and goals. It is advisable to consult with a financial advisor or credit counselor to determine the most appropriate course of action.

Frequently Asked Questions

What is the impact of bankruptcy on an individual’s credit score?

Bankruptcy can significantly lower an individual’s credit score, as it indicates a history of financial instability and an inability to manage debt effectively.

How long does a bankruptcy remain on a credit report?

A bankruptcy typically remains on a credit report for 7 to 10 years, depending on the type of bankruptcy filed.

What steps can an individual take to repair their credit after bankruptcy?

Credit repair after bankruptcy involves rebuilding a positive credit history by making timely payments, reducing debt, and seeking professional guidance from credit counselors.